Power of Attorney in Montana: Everything You Need to Know

In Montana, establishing a Power of Attorney allows you to legally designate someone to make critical healthcare and financial decisions on your behalf.

To create a Power of Attorney in Montana, you must be at least 18 years old and mentally competent, and the document must be notarized and, depending on the type, witnessed. There are several types of Power of Attorney available in Montana, including Durable, Medical, and Financial, each tailored to meet different aspects of your healthcare and financial management needs.

This comprehensive guide from Montana Elder Law will walk you through everything you need to know, from the legal requirements to the revocation process.

Key Takeaways

- Importance of Power of Attorney: A vital legal document that can significantly impact your healthcare and financial decisions.

- Montana’s Legal Requirements: You must be 18 years old and mentally competent, with the document properly notarized and witnessed.

- Types of Power of Attorney: Montana recognizes Durable, Medical, and Financial Powers of Attorney, each serving different needs.

- Revocation Process: Learn the specific legal steps and documentation required to revoke a Power of Attorney in Montana.

- Choosing the Right Agent: The agent you choose will have significant authority over your affairs, so choose wisely.

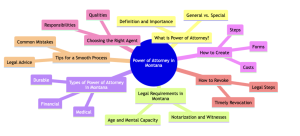

Figure 1: Mind Map for Montana Power of Attorney

What is Power of Attorney?

- Definition: At its core, a Power of Attorney is a legal document that grants one individual the authority to act for another.

- Importance: The stakes are high. This document can control who manages your healthcare, finances, and even end-of-life decisions. It’s about ensuring your wishes are honored when you’re not in a position to enforce them yourself.

- General vs. Special: Montana recognizes two main types. A General Power of Attorney provides your agent with wide-ranging powers, from handling your finances to making healthcare decisions. On the other hand, a Special Power of Attorney narrows down the scope, limiting your agent’s authority to specific tasks or timeframes. (1)

Legal Requirements in Montana

Before you can establish a Power of Attorney in Montana, there are certain legal requirements that must be met:

- Age and Mental Capacity: The principal must be at least 18 years old and mentally competent.

- Notarization and Witnesses: Montana law requires the document to be notarized. Some types may also require witnesses.

Legal Requirements Table

| Requirement | Description |

| Age | Must be at least 18 years old |

| Mental Capacity | Must be mentally competent |

| Notarization | Required for all types |

| Witnesses | May be required depending on the type |

Types of Power of Attorney in Montana

Montana’s legal framework offers you a diverse array of Power of Attorney types, each designed to cater to unique needs and situations.

- Durable Power of Attorney: Think of this as your legal safety net for the long haul. It stays in effect even if you lose mental capacity, making it indispensable for long-term planning. This type covers both healthcare and financial decisions, so choose your agent with the utmost care.

- Medical Power of Attorney: This acts as your voice in medical matters when you can’t speak for yourself. From treatment choices to end-of-life decisions, this document ensures someone familiar with your values steps in.

- Financial Power of Attorney: Imagine having a personal CFO; that’s what this type does. It grants your agent the authority to manage your financial affairs, from mundane bill payments to complex investment decisions.

How to Create a Power of Attorney in Montana

Creating a Power of Attorney in Montana is laying the foundation for your future.

Choose an Agent: This is step one and it’s crucial. Your agent should be someone who’s not just reliable but also capable of making nuanced decisions under pressure.

Find the Right Form: Montana offers specific forms for each type of Power of Attorney. Make sure you pick the one that aligns with your needs.

Consult a Lawyer: While not mandatory, legal advice can provide invaluable insights into the complexities of Montana law.

Choosing the Right Agent

Your agent isn’t just a name on paper; they’re a major sculpter of your future.

- Reliability: Your agent should inspire confidence, backed by a track record of sound decision-making.

- Knowledgeability: They should understand the legal and ethical responsibilities that come with this role.

How to Revoke a Power of Attorney

Revoking a Power of Attorney in Montana isn’t as simple as tearing up a paper.

- Written Notice: Draft a formal written notice. Make your intention to revoke clear and unequivocal.

- Notify the Agent: Inform your agent immediately, preferably through certified mail to leave a paper trail.

- File with Relevant Institutions: If your Power of Attorney was filed with any banks, healthcare providers, or legal entities, you’ll need to provide them with a copy of the revocation notice. This ensures that they are aware of the change and act accordingly.

- Destroy Original Copies: To prevent any future misunderstandings, it’s advisable to destroy all original and photocopies of the Power of Attorney document. Make sure to retrieve any copies that might be with third parties.

Tips for a Smooth Power of Attorney Process

Embarking on the Power of Attorney journey can be like navigating a labyrinth. But don’t worry, here are some seasoned tips to guide you through the maze.

Avoid Common Pitfalls: One of the most common mistakes people make is setting and forgetting their Power of Attorney document. This isn’t a one-and-done deal. Regularly reviewing your document is essential.

Laws can change, and so can your personal circumstances. Maybe you’ve had a falling out with your chosen agent, or perhaps Montana law has introduced new requirements. Keep your document up-to-date to ensure it serves its intended purpose when needed.

Legal Consultation: While you might be tempted to go it alone, consulting a lawyer can be a game-changer. A legal expert can help you understand the nuances of Montana’s Power of Attorney laws, from the types of powers you can delegate to the legal language that should be used in the document.

They can also help you tailor the document to your specific needs, ensuring that you’re not granting too much or too little power to your agent.

Think of this as an investment in your future; the cost of a consultation now could save you from costly mistakes down the line.

By keeping these tips in mind, you can make the Power of Attorney process in Montana much smoother and more effective.

Power of Attorney Explained | Montana Elder Law

Understanding the Power of Attorney laws in Montana is crucial for anyone looking to secure their future, whether it’s healthcare, finances, or both. By adhering to Montana’s specific legal requirements and choosing the right agent, you can ensure that your interests are well-protected.

If you need any legal advice regarding elder law in Montana, give Montana Elder Law a call today, and let us take the worry out of your future!

References:

- Laws.Montana.Gov, Statutory Form Power Of Attorney, https://leg.mt.gov/bills/mca/title_0720/chapter_0310/part_0030/section_0530/0720-0310-0030-0530.html