Power of Attorney in Montana: Everything You Need to Know

January 2, 2024

Safeguarding Montana’s Seniors: Strategies to Prevent Financial Fraud and Scams

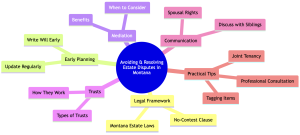

January 13, 2024Estate disputes among siblings can be emotionally and financially draining.

In Montana, where estate laws have some unique characteristics, understanding the legal landscape is crucial. This article aims to guide you through the complexities of avoiding and resolving estate disputes in Montana.

Key Takeaways

- Early Planning is Essential for Preventing Disputes: Starting your estate planning early can help avoid legal complications and sibling disputes down the line.

- Montana Has Specific Legal Provisions That Can Help: Montana’s unique estate laws offer tools like no-contest clauses to discourage will contests and disputes.

- Mediation and Trusts Can Be Effective Tools for Resolution: In Montana, mediation services and various types of trusts can provide alternative pathways to resolve estate disputes amicably.

Why Estate Disputes Occur

Estate disputes are not always just about money or property – they are often fueled by emotional issues that have been simmering for years. Understanding the root causes can help in finding a resolution.

- Emotional Factors: Sibling rivalry or unresolved issues can resurface.

- Financial Complexities: The varied financial needs of each sibling can create conflict.

- Lack of Clear Communication: Misunderstandings can escalate into full-blown disputes.

The Montana Legal Framework

Montana has specific laws that govern estate planning and disputes. Being aware of these can help you navigate the complexities.

Montana Estate Laws

In Montana, the probate process is generally required for estates valued over $50,000 or that include real estate. Understanding this financial threshold is crucial for estate planning, as failing to do so could result in unnecessary legal complications and delays in asset distribution.

No-Contest Clause

A no-contest clause can discourage beneficiaries from contesting the will. However, this clause is not foolproof and can be challenged under Montana law.

Table 1: Comparison of Estate Laws in Montana and Other States

| Feature | Montana | Other States | Why It Matters |

| No-Contest Clause | Partially Enforceable | Varies | A no-contest clause in Montana is enforceable but can be challenged, offering a deterrent against will contests. |

| Probate Process | Required for larger estates | Usually Required | Understanding the probate process is crucial as Montana requires it for estates above a certain value. |

| Estate Tax | None | Varies | Montana does not impose an estate tax, potentially saving beneficiaries a significant amount of money. |

Early Planning: The First Line of Defense

The sooner you start planning, the better. Early planning not only prevents disputes but also ensures that the estate is divided as per the wishes of the deceased.

Write the Will Early

The absence of a will can lead to chaos.

In Montana, dying intestate means the state laws will decide the division of assets – which may not align with your wishes.

Update the Will Regularly

Life changes like marriage, divorce, or the birth of a grandchild should trigger a will update. In Montana, failing to update your will can result in unintended beneficiaries.

Steps to Update Your Will in Montana

- Review the existing will

- Consult with an estate planning attorney

- Make the necessary changes and get it notarized

The Role of Mediation in Montana

Mediation can be a less confrontational and more cost-effective way to resolve estate disputes.

Mediation is often encouraged as a first step before taking legal action.

When to Consider Mediation

If direct communication has failed and the dispute is escalating, it’s time to consider mediation.

It’s especially useful when the disputing parties have ongoing relationships they wish to preserve.

Benefits of Mediation

- Confidentiality: Unlike court proceedings, mediation is private.

- Control: Parties have more control over the outcome.

- Speed: Resolutions are usually faster than court settlements.

Creating a Trust: An Effective Strategy

Trusts can be an excellent tool for estate planning, offering more control and potentially less tax liability.

Types of Trusts

In Montana, you can choose from several types of trusts, each with its unique benefits and drawbacks.

Types of Trusts and Their Uses

- Revocable Trust:

- This type of trust can be altered or revoked during the grantor’s lifetime, offering flexibility in asset management.

- Irrevocable Trust:

- Once established, this trust cannot be changed. It provides strong asset protection and potential tax benefits.

- Charitable Trust:

- This trust is specifically designed to benefit a charitable organization, often providing the grantor with tax deductions. (1)

How Trusts Work in Montana

Trusts can bypass the probate process and offer a quicker distribution of assets.

However, they require careful planning and regular maintenance.

Communication: The Underestimated Tool

Open communication can prevent many disputes. It’s crucial to discuss estate planning with your siblings and other beneficiaries to ensure everyone is on the same page.

Discuss with Siblings

Honest conversations can prevent misunderstandings and future disputes. Discuss who gets what and why, and consider everyone’s feelings and expectations.

Montana Laws Regarding Spousal Rights

Spouses in Montana have the right to an “elective share” of the deceased spouse’s estate – even if the will states otherwise.

This elective share is generally one-third of the estate and is designed to prevent spouses from being completely disinherited.

Additionally, Montana law provides for a “family allowance” to support the surviving spouse and minor children during the probate process.

Understanding these specific spousal rights can help prevent disputes between siblings and surviving spouses over the division of assets.

Practical Tips for Montana Residents

These actionable tips can help Montana residents in effective estate planning.

Recommended Estate Planning Professionals in Montana

- Estate Lawyers

- Financial Advisors

- Tax Consultants

Conclusion

Estate disputes can be emotionally taxing and financially draining. However, with early planning, open communication, and a solid understanding of Montana’s legal landscape, you can navigate this challenging terrain. Whether it’s through mediation, setting up a trust, or simply talking openly with your siblings, there are multiple paths to finding a resolution.

If you have any more questions about estate disputes in Montana, Montana Elder Law is a seasoned and reliable resource for all of your elder law needs. They will listen to your concerns and provide you with sound legal services in a way that makes you feel like family.

Reference

- Montana State Law Library, https://courts.mt.gov/library