How to Avoid and Resolve Estate Disputes Between Siblings in Montana

January 13, 2024

Montana Elder Law: Preparing for Incapacity with Legal Tools and Tips

January 13, 2024Financial fraud and scams can have devastating effects on seniors, often targeting their life savings and sense of security. Montana’s elderly population is not immune to these threats. With the rise of sophisticated scams, we must arm our seniors with knowledge and resources to protect themselves. This article delves into the strategies and measures that can be implemented to safeguard Montana’s seniors from financial fraud.

Key Takeaways:

- Scam Awareness: Stay informed about the latest scams and recognize the warning signs to prevent financial abuse.

- State Resources: Utilize state agencies for protective measures and recovery support in cases of elder fraud.

- Proactive Prevention: Adopt proactive strategies, including financial education and community engagement, to safeguard against fraud.

- Legal Support: Access legal resources and victim assistance programs to navigate the aftermath of financial scams.

- Focused Education: Prioritize financial literacy, with a special emphasis on understanding and managing property taxes to prevent exploitation.

Understanding the Threat

Elder financial abuse is a growing concern, with scammers constantly devising new methods to exploit seniors.

Understanding these threats is the first line of defense. This section will cover the most prevalent scams, from government impersonation to property tax deception, and provide insights into recognizing the red flags of financial abuse.

The Role of State Agencies

State agencies are indispensable in the fight against financial fraud targeting seniors.

They maintain hotlines for reporting scams, ensuring that seniors have a direct line to report any suspicious activity swiftly.

Additionally, these agencies offer educational programs aimed at increasing awareness about the types of scams that are prevalent and the tactics used by fraudsters. They also provide clear guidance on how seniors can effectively use these services to their advantage.

Preventative Measures

For personal protection, seniors are encouraged to take proactive steps. This includes securing personal information with robust passwords and being judicious about sharing sensitive details.

Regular monitoring of financial accounts is advised to catch any unauthorized transactions early. Understanding consumer rights is also critical, empowering seniors to confidently decline unsolicited and potentially dubious offers.

Keeping abreast of the latest scam tactics through reliable sources further fortifies their defenses against potential financial exploitation.

Legal and Support Framework

Montana’s seniors have a legal safety net designed to catch and address instances of financial fraud. This framework includes laws and regulations specifically aimed at protecting older adults from financial abuse. Here’s a closer look at the legal avenues and support systems in place:

- Elder Justice Act: Provides federal resources to prevent elder abuse.

- Montana Securities Act: Offers protection against investment scams.

- Consumer Protection Laws: Safeguard against deceptive trade practices.

Community and Support Services

Community services are the unsung heroes in the fight against elder financial abuse. They provide education, support groups, and intervention services. Below is a list of community-based initiatives that have proven effective:

- Senior Centers: Offer educational workshops on financial literacy.

- Adult Protective Services: Investigate and respond to reports of elder abuse.

- Legal Aid Services: Provide free legal advice to seniors in financial distress.

National Strategies and Adaptation

The fight against elder financial abuse is not just a local concern; it’s a national priority. This section will discuss the strategies implemented at the federal level and how they trickle down to aid seniors in Montana:

- Federal Trade Commission (FTC) Initiatives: Nationwide efforts to crack down on scams.

- The Elder Abuse Prevention and Prosecution Act: A legal framework to prosecute fraudsters.

Financial Education for Seniors

Financial education stands as a formidable shield against the onslaught of financial fraud targeting seniors.

When seniors are well-versed in the intricacies of financial matters, their susceptibility to scams diminishes significantly. Empowerment through education can take various forms, such as gaining a robust understanding of financial products. This includes not just a cursory glance but a deep dive into the common financial instruments available to them, along with an assessment of the associated risks.

Furthermore, equipping seniors with the skills to recognize scam tactics is crucial. Training programs and workshops that help them identify and appropriately respond to suspicious activities can serve as a critical line of defense.

Addressing Property Tax Concerns

Property tax scams, in particular, pose a significant risk to senior homeowners.

To combat this, seniors need clear and actionable guidance on how to protect themselves. A vital step in this protection is the verification of tax-related communications.

Seniors must be educated on distinguishing between legitimate property tax bills and fraudulent ones. Additionally, they should be informed about the appropriate channels for reporting suspicious activity. Knowing where and how to report can expedite interventions and prevent further victimization. Through these educational efforts, seniors can stand firm against the tactics of scammers, ensuring their financial stability and peace of mind.

Table 1: Key Resources for Montana’s Seniors

| Resource | Description |

| Montana Office of Consumer Protection | Provides assistance with consumer complaints and fraud. |

| Area Agencies on Aging | Offers access to a variety of services for seniors. |

| National Council on Aging | Provides educational resources on financial security. |

Expanding the Fight Against Elder Financial Abuse

The battle against financial scams targeting seniors is multifaceted, involving community vigilance, legal action, and personal empowerment. To truly safeguard our seniors, we must expand our efforts and deepen our understanding of the issue.

In-Depth Scam Analysis

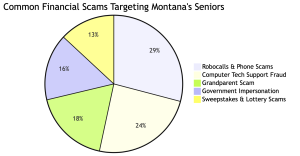

A thorough analysis of common scams can equip seniors with the knowledge to spot and avoid them. Here’s an expanded list of scams that frequently target older adults:

- Grandparent Scams: Impostors pretend to be a grandchild in distress, seeking money.

- Medicare Scams: Scammers pose as Medicare representatives to extract personal information.

- Lottery Scams: Victims are told they’ve won a prize but must pay a fee to claim it.

Each of these scams has telltale signs that, once known, can be a powerful deterrent to potential fraud.

Building a Supportive Community Network

A strong community network can provide a support system for seniors, helping them stay informed and connected. Here are some ways communities can help:

- Neighborhood Watch Programs: Encourage vigilance and reporting of suspicious activities.

- Financial Literacy Workshops: Regularly scheduled events to educate seniors on financial matters.

- Social Groups: Foster connections among seniors to reduce isolation, which can lead to vulnerability.

Leveraging Technology for Protection

Technology can be a double-edged sword; while it can expose seniors to online scams, it can also be used to protect them. Here are some technological tools that can help:

- Scam Alert Systems: Services that notify subscribers of the latest scams.

- Online Banking Alerts: Set up alerts for unusual account activity.

- Personal Data Protection Software: Programs that secure personal information on computers and online.

Engaging with Law Enforcement

Law enforcement agencies play a vital role in protecting seniors from financial abuse. They offer educational seminars to arm seniors with knowledge against fraud, deploy specialized task forces to investigate and combat elder financial abuse, and provide victim assistance programs to support those affected.

These multifaceted efforts by police departments and other legal entities are essential in both preventing scams and ensuring support and recourse for seniors who financial predators have targeted.

Policy and Legislation

Policies and legislation at both the state and federal levels are essential to provide a structured response to elder financial abuse. Here’s what’s being done:

- Elder Justice Act: Allocates funds to support elder abuse victims and prevent future abuse.

- Senior Safe Act: Encourages financial services to train employees to spot and report elder financial abuse.

Long-Term Strategies for Financial Security

To ensure long-term financial security for seniors, it’s essential to look at sustainable strategies:

- Retirement Planning: Education on how to plan for a financially secure retirement.

- Investment Advice: Information on safe investment practices for seniors.

- Estate Planning: Assistance with wills, trusts, and estate management to prevent fraud.

Table 2: Strategies for Combating Elder Financial Abuse

| Strategy | Description | Implementation |

| Education | Providing ongoing financial literacy education to seniors. | Workshops, seminars, online courses. |

| Community Support | Establishing networks for seniors to share information and support. | Social groups, community centers, and online forums. |

| Legal Action | Utilizing the legal system to deter scammers and protect seniors. | Legislation, law enforcement task forces, legal aid. |

| Technology | Using technology to alert and protect seniors from scams. | Alert systems, data protection software, and online resources. |

The fight against elder financial abuse requires a comprehensive approach that includes education, community support, legal action, and the intelligent use of technology.

By expanding our efforts and continuing to innovate, we can create a safer financial environment for Montana’s seniors, ensuring their golden years are secure and prosperous.

Fostering Resilience Against Financial Predators

To wrap up our comprehensive guide on safeguarding Montana’s seniors from financial fraud and scams, we must emphasize the importance of resilience. Building a resilient community involves not just education and prevention but also a robust response to incidents of financial abuse.

Empowering Seniors Through Education

Continuous education remains the cornerstone of empowerment. Seniors equipped with the latest information on scam tactics are less likely to become victims. Here are additional educational topics that can fortify their defenses: (1)

- Digital Literacy: Understanding the basics of Internet safety and digital communication.

- Investment Scams: Identifying red flags in investment opportunities.

- Charity Fraud: Learning to verify legitimate charities and avoid fraudulent ones.

Strengthening Legal Recourse

When prevention fails, a robust legal recourse is essential. Enhancing the legal framework to support seniors after an incident of financial abuse can help them recover and deter future crimes. This includes:

- Streamlined Reporting Processes: Making it easier for seniors to report scams.

- Enhanced Prosecution: Ensuring that financial predators face justice.

- Restitution Programs: Helping seniors recover lost funds.

Collaborative Community Efforts

A collaborative approach can significantly amplify the impact of anti-fraud measures. This involves:

- Interagency Cooperation: Different agencies work together to provide comprehensive support.

- Public-Private Partnerships: Leveraging resources from both sectors to fund and implement anti-fraud programs.

- Volunteer Initiatives: Mobilizing community members to assist seniors in various capacities.

The Role of Family and Caregivers

Family members and caregivers are often the first line of defense against elder financial abuse. They can:

- Monitor Financial Health: Monitor the senior’s financial activities for any irregularities.

- Educate on Scams: Regularly discuss new and emerging scams with seniors.

- Assist with Technology: Help set up and maintain secure technological tools.

Table 3: Action Plan for Senior Financial Security

| Action Item | Description | Who’s Involved |

| Regular Scam Updates | Providing up-to-date information on the latest scams. | Agencies, community centers, online platforms. |

| Financial Health Checks | Periodic reviews of financial statements and accounts. | Families, financial advisors, banks. |

| Secure Technology Setup | Ensuring seniors have access to and understand secure technology. | Caregivers, tech volunteers, community programs. |

Conclusion: A Call to Action

Protecting our seniors from financial fraud is not just a matter of individual security but a reflection of our societal values. It requires the collective effort of individuals, communities, and institutions to create an environment where seniors can live without the fear of financial predation.

As we conclude this article, let’s remember that the fight against elder financial abuse is ongoing and dynamic. It demands our vigilance, compassion, and action. By implementing the strategies discussed, we can aspire to a future where financial security is a reality for all seniors.

If you or your family is in need of expert elder law attorneys, Montana Elder Law is a resource for you. Our attorneys have helped countless Montanians manage their finances, navigate legal processes and plan successful retirements. This is what we love to do, so please don’t hesitate to call!

In the spirit of continuous improvement and protection, we encourage readers to share this information and become advocates for elder financial safety. Together, we can build a bulwark against the financial threats facing our seniors.

Reference:

- “Help Stop Elder Financial Abuse,” AARP, https://states.aarp.org/virginia/help-stop-elder-financial-abuse#:~:text=Be%20a%20fraud%20fighter!,%2D877%2D908%2D3360.&text=Connecting%20you%20to%20what%20matters%20most%2C%20like%20neighbors%20do.