7 Reasons You Should Update Your Estate Plan Regularly: A Guide for Montana’s Seniors

January 13, 2024

Guardianship and Elderly Care: Making Informed Decisions

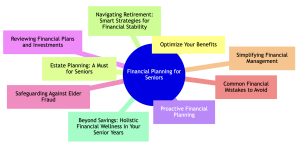

January 15, 2024Navigating the complexities of financial planning as a senior can be daunting. With the right strategies, however, common pitfalls can be avoided, ensuring a stable and secure financial future. This article aims to provide seniors with comprehensive guidance on optimizing benefits, updating estate plans, and safeguarding against fraud. By understanding these key areas, seniors can confidently manage their finances during retirement.

Key Takeaways

- Maximizing Benefits: Leveraging available benefits for long-term care and financial support.

- Estate Planning: Keeping estate plans and wills current to protect and provide for loved ones.

- Proactive Planning: Early financial planning to ensure security in senior years.

- Investment Review: Tailoring investment strategies to meet changing needs and minimize risks.

- Fraud Protection: Implementing measures to protect against identity theft and financial scams.

Optimize Your Benefits

Financial planning for seniors often begins with understanding and maximizing available benefits. This includes navigating private insurance, long-term care (LTC) insurance, and veteran’s benefits. It’s crucial to explore how these can be optimized to cover the costs of caregivers, assisted living, or memory care.

For instance, while not covered by Medicare, many senior living options can be funded through private pay or LTC insurance.

Additionally, veterans or their surviving spouses might be eligible for federal monthly pensions, which can significantly aid in covering personal care costs.

Table: Key Benefits and Optimization Strategies for Seniors

| Benefit Type | Description | Optimization Tips |

| Private Insurance | Covers various health and care needs. | Review policies annually to ensure they meet current health care needs. |

| LTC Insurance | Specifically designed for long-term care expenses. | Purchase in mid-50s to early 60s for optimal rates and benefits. |

| Veteran’s Benefits | Provides additional support for veterans and their spouses. | Check eligibility for pensions and other specialized programs. |

| Medicare | Offers basic health coverage for seniors. | Understand the limitations and supplement with additional insurance if needed. |

Understanding these benefits and how to make the most of them is a critical step in securing financial stability in the senior years. It’s not just about having these benefits but knowing how to use them effectively to support long-term care goals.

Estate Planning: A Must for Seniors

Estate planning is not a one-time task but an ongoing process, especially important for seniors. Keeping your estate plan, will, and asset titling updated ensures that your wishes are respected and your loved ones are protected. Major life events, such as changes in laws, moving into senior living, or acquiring significant assets, should trigger a review of your estate plan. This provides peace of mind and ensures that your assets are distributed according to your wishes.

Involving family members in these discussions can be beneficial. Thomas Saunders, a Certified Financial Planner, suggests hosting a family meeting to discuss the estate plan and any assigned roles, such as power of attorney. This transparency can prevent misunderstandings and ensure that everyone is on the same page regarding financial matters.

Proactive Financial Planning

When it comes to securing financial stability in your senior years, being proactive is vital. This means planning early for potential long-term care needs and considering future living arrangements. For example, if you plan to sell your home and move into a senior living community, it’s best to start this process well before it becomes necessary. Proactive budgeting and planning can help you maximize your assets, reduce the burden on your loved ones, and avoid complications down the road. (1)

Reviewing Financial Plans and Investments

Regularly reviewing and adjusting your financial plan and investment portfolio is essential for seniors. As your needs and the economic landscape change, so should your financial strategies. This involves:

- Assessing Risk Tolerance: With age, your risk tolerance may decrease. Adjusting your investment portfolio to reflect a more conservative approach if necessary is important.

- Diversification: Ensure your investments are diversified to spread risk. This might include a mix of stocks, bonds, and other assets.

- Regular Consultations with Financial Advisors: An experienced financial advisor can provide valuable insights and help you navigate complex financial decisions.

Safeguarding Against Elder Fraud

Elder fraud is an increasingly serious issue, with seniors often being prime targets for scammers. Protecting yourself requires a combination of staying informed, securing personal information, and seeking trusted advice.

- Stay Informed: Be aware of common scams targeting seniors, such as fraudulent phone calls or phishing emails.

- Secure Personal Information: Secure sensitive information like social security numbers and bank account details.

- Seek Trusted Advice: Consult with trusted family members or financial advisors before making significant financial decisions.

Common Financial Mistakes to Avoid

Several financial missteps can significantly impact seniors’ financial security.

One of the most common mistakes is drawing Social Security benefits too early. Starting to receive benefits at the earliest age of 62 can result in permanently reduced payouts. This decision not only affects your monthly income but also sets the baseline for any future cost-of-living adjustments.

Another frequent error is spending retirement assets too soon. It’s essential to create a budget that accounts for regular and unexpected expenses and carefully manage withdrawals from savings and investment accounts. This approach helps ensure that your funds last throughout your retirement years.

Additionally, seniors must remember to make Required Minimum Distributions (RMDs) from tax-deferred accounts like 401(k)s and IRAs starting at age 72. Failing to do so can result in hefty penalties.

Simplifying Financial Management

As seniors age, simplifying financial management can lead to greater ease and less stress. This simplification process often involves consolidating accounts and automating bill payments. Consolidating financial accounts, such as bank accounts, retirement accounts, and investment portfolios, can make it easier to manage your finances. It reduces the complexity of keeping track of multiple accounts and statements, making it more straightforward to monitor your overall financial health. Automating bill payments is another effective strategy. It ensures that all bills are paid on time, avoiding late fees and reducing the hassle of manual payments. This approach is not only convenient but also helps in maintaining a good credit score.

The Role of a Trusted Financial Overseer

Another key aspect of simplifying financial management is designating a trusted person, such as a family member or a financial advisor, to help oversee your finances. This person can assist in monitoring accounts, making financial decisions, and ensuring that your financial plan stays on track. It’s important to choose someone who is trustworthy and has a good understanding of your financial goals and preferences.

Navigating Retirement: Smart Strategies for Financial Stability

Retirement is a significant life transition that requires careful financial planning. Smart strategies for financial stability in retirement include:

- Budgeting for Retirement: Create a realistic budget that accounts for all sources of income and expenses. This budget should be flexible enough to adapt to changes in your lifestyle and financial situation.

- Planning for Healthcare Costs: Healthcare costs can be a major expense in retirement. Consider options like Medicare, supplemental insurance, and long-term care insurance to cover these costs.

- Staying Financially Active: Engage in activities that keep you financially active, such as part-time work, volunteering, or even managing a small business. This provides additional income and keeps you mentally and socially engaged.

Beyond Savings: Holistic Financial Wellness in Your Senior Years

Achieving financial wellness in your senior years goes beyond mere savings. It encompasses a holistic approach that includes:

- Mental and Emotional Well-being: Financial stress can take a toll on your mental and emotional health. Engaging in enjoyable activities and maintaining a social network can help alleviate this stress.

- Physical Health: Good physical health can reduce healthcare costs and improve your quality of life. Regular exercise, a balanced diet, and routine medical check-ups are essential.

- Estate and Legacy Planning: Consider how you want to be remembered and what legacy you wish to leave. This may involve charitable giving, setting up trusts, or ensuring that your family is cared for according to your wishes.

Wrapping Up

Navigating the financial landscape as a senior can be complex, but with the right strategies and awareness, it’s possible to avoid common pitfalls and secure a stable financial future. From optimizing benefits and managing investments to safeguarding against fraud and simplifying financial management, each aspect is crucial in ensuring financial well-being in the golden years. Remember, proactive planning and staying informed are crucial to maintaining financial stability and peace of mind during retirement.

For those seeking expert guidance in financial planning for seniors, Montana Elder Law offers a wealth of resources and professional advice. Their expertise in elder law can provide invaluable support in navigating the unique financial challenges that seniors face, helping to create a secure and prosperous future. Whether it’s estate planning, benefit optimization, or protecting against fraud, turning to professionals like Montana Elder Law can make a significant difference in your financial journey as a senior.

References:

(1) A Guide to Finance for Seniors , Maureen Stanley, https://www.seniorliving.org/finance/