Veterans Benefits in Montana: How Elder Law Attorneys Can Assist

January 13, 2024

Financial Planning for Seniors: Avoiding Common Pitfalls

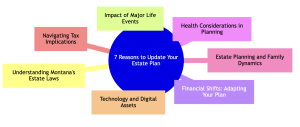

January 15, 2024In Montana, estate planning is a dynamic process, essential for seniors to ensure their wishes are honored and their legacies secured. As life’s circumstances and laws change, so should your estate plan. This guide highlights seven compelling reasons for Montana’s seniors to review and update their estate plans regularly.

Key Takeaways

- Stay Current with Legal Changes: Montana’s estate laws evolve, impacting estate planning.

- Adapt to Life Events: Major life changes necessitate updates to your estate plan.

- Financial Shifts Matter: Changes in financial status should be reflected in your estate plan.

- Health Considerations are Crucial: Adjust your plan with changing health needs.

- Family Dynamics Influence Planning: Keep your estate plan aligned with family changes.

Understanding Montana’s Estate Laws: Changes and Implications

Montana’s estate laws are subject to change, often influenced by legislative updates and judicial interpretations. These changes can have significant implications for estate planning, affecting everything from asset distribution to tax considerations. For Montana’s seniors, staying informed about these changes is crucial for several reasons:

- Compliance with Current Laws: Estate plans must comply with current state laws to be effective. Non-compliance can lead to legal disputes or unintended distribution of assets.

- Maximizing Estate Value: Understanding new tax laws and exemptions can help in structuring an estate plan to maximize the value passed on to beneficiaries.

- Adapting to Legal Innovations: New legal tools and structures, such as digital wills or trust options, may offer better ways to achieve estate planning goals.

Action Steps:

- Regular Consultations with Estate Planning Attorneys: Schedule annual or bi-annual meetings with legal professionals to review and update your estate plan.

- Stay Informed: Keep abreast of legislative changes in Montana that could impact estate planning.

- Review and Revise Documents: Regularly review wills, trusts, and other estate planning documents to ensure they align with current laws.

The Impact of Major Life Events on Your Estate Plan

Life events such as marriage, divorce, the birth of a grandchild, or the loss of a loved one can significantly impact your estate plan. These events can change your priorities and wishes regarding asset distribution, guardianship, and beneficiaries. Here’s why it’s essential to update your estate plan in response to major life events:

- Reflecting Current Relationships: Your estate plan should reflect your current familial and personal relationships. For instance, you may want to include your spouse in your will or as a beneficiary in your insurance policies after a marriage.

- Protecting New Family Members: The arrival of new family members, like grandchildren, often necessitates adding them as beneficiaries or setting up trusts for their future.

- Preventing Unintended Beneficiaries: In the case of divorce, it’s crucial to update your estate plan to prevent an ex-spouse from unintentionally inheriting assets. (1)

Action Steps:

- Review Estate Plan After Major Life Events: Promptly revise your estate plan following significant life changes.

- Update Beneficiary Designations: Ensure that beneficiary designations on retirement accounts, life insurance policies, and other assets are current.

- Consider Trusts for New Beneficiaries: Establish trusts to manage assets for new beneficiaries, like minors or those with special needs.

Financial Shifts: Adapting Your Estate Plan to New Circumstances

Your financial landscape can change significantly over time. Retirement, property acquisition, or investment changes require adjustments to your estate plan. Regular updates ensure your plan accurately reflects your current financial situation.

Table: Key Financial Changes and Their Impact on Estate Planning

| Financial Change | Impact on Estate Plan | Action Steps for Montana Seniors |

| Retirement | Change in income flow | Review asset distribution strategies |

| Property Acquisition | Increase in assets | Update asset allocation and beneficiaries |

| Investment Changes | Fluctuations in asset value | Adjust estate plan to reflect current asset values |

Health Considerations and Estate Planning

For Montana’s seniors, incorporating health considerations into estate planning is essential. As health conditions change over time, it’s important to ensure that your estate plan reflects these changes. This includes updating healthcare directives and powers of attorney to align with your current health status and care preferences. Regularly revising these documents is crucial for maintaining control over your healthcare decisions.

Key Steps to Integrate Health Considerations into Your Estate Plan:

- Update Healthcare Directives Regularly:

- Ensure living wills reflect your current medical care preferences.

- Consider changes in health conditions and treatment preferences.

- Review Durable Power of Attorney for Healthcare:

- Confirm the designated individual aligns with your current choice for making healthcare decisions.

- Discuss your updated health views and wishes with this person.

- Plan for Long-Term Care Needs:

- Assess if your estate plan adequately provides for potential long-term care.

- Explore insurance or trust options for long-term healthcare funding.

- Align Financial Planning with Health Needs:

- Review and adjust your financial plan to support ongoing and future healthcare needs.

- Ensure insurance policies and retirement savings are adequate for expected healthcare costs.

- Maintain Communication with Healthcare Providers:

- Inform your doctors about any legal documents related to your healthcare decisions.

- Provide updated copies of healthcare directives to your medical team.

- Consult with Estate Planning Professionals:

- Regularly meet with an attorney to keep health-related legal documents current and legally compliant.

- Stay informed about any changes in state laws affecting healthcare directives.

Estate Planning and Family Dynamics

Family dynamics are a critical aspect of estate planning. Changes in the family, such as marriages, divorces, or the addition of new members, can significantly impact how you wish to distribute your assets. It’s essential to periodically review and adjust your estate plan to mirror these changes, ensuring it accurately reflects your current family situation and wishes.

Key Considerations for Adjusting Estate Plans to Family Dynamics:

- Marriage or Remarriage: Incorporate your spouse into your estate plan, considering their needs and any step-children.

- Divorce: Remove ex-spouses from wills and beneficiary designations to prevent unintended asset distribution.

- Birth or Adoption of Children/Grandchildren: Update your estate plan to include these new family members as beneficiaries.

- Loss of a Family Member: Adjust your estate plan to account for the changed family structure and redistribute assets accordingly.

Navigating Tax Implications in Estate Planning

Tax considerations are an integral part of estate planning. Montana’s seniors must be aware of how state and federal tax laws affect their estate. Changes in tax laws can influence the value of the estate and the amount beneficiaries receive. Regular reviews of your estate plan with a tax professional can help minimize tax liabilities and ensure your beneficiaries receive the maximum benefits.

Technology and Digital Assets in Estate Planning

In today’s digital era, including digital assets in your estate plan is increasingly important. Montana’s seniors should consider how to handle digital assets like social media accounts, online banking, and digital currencies. These assets require specific planning to ensure they are managed according to your wishes.

Steps to Include Digital Assets in Your Estate Plan:

- List All Digital Assets: Include everything from online accounts to digital currencies.

- Designate Access: Provide clear instructions on who can access these digital assets.

- Outline Distribution Plans: Specify how you want these assets managed or distributed.

Reviewing and Updating Beneficiaries

Regularly reviewing and updating your beneficiaries is a fundamental aspect of estate planning, especially for Montana’s seniors.

Life events such as marriages, births, and deaths can significantly impact your decisions on who should inherit your assets. It’s crucial to ensure that your estate plan accurately reflects your current wishes by keeping beneficiary designations up to date. This process involves more than just revising your will; it extends to all aspects of your estate, including retirement accounts, life insurance policies, and any other accounts with designated beneficiaries.

The importance of this step cannot be overstated. Outdated beneficiary designations can lead to unintended consequences, where assets may go to former spouses or estranged family members, rather than to the intended heirs. It’s advisable to review beneficiary designations after any major life event or at least every few years. This review should include checking that all listed beneficiaries are still appropriate and that contingent beneficiaries are named in case the primary beneficiary is unable to inherit.

Additionally, it’s important to consider the implications of leaving assets to minors, as they may require a guardian or trust to manage the inheritance until they reach legal age. By keeping your beneficiary designations current, you can have peace of mind knowing that your assets will be distributed according to your most recent wishes, reflecting the current dynamics of your family and relationships.

The Role of Trusts in Estate Planning

Trusts can be a valuable tool in estate planning, offering flexibility and control over how your assets are distributed. They can provide tax benefits, protect assets from creditors, and specify conditions for asset distribution.

Advantages of Using Trusts in Estate Planning:

- Control Over Asset Distribution: Specify how and when your assets are distributed.

- Protection from Creditors: Safeguard your assets from potential creditors.

- Tax Benefits: Potentially reduce estate taxes and provide financial benefits to beneficiaries.

Concluding Thoughts: The Importance of Professional Guidance

Regular updates to your estate plan are not just a recommendation; they are essential for ensuring that your wishes are accurately reflected and executed. For Montana’s seniors, staying abreast of changes in estate laws, adapting to life events, managing financial shifts, considering health implications, understanding family dynamics, navigating tax implications, and incorporating digital assets are all critical components of a comprehensive estate plan. By regularly reviewing and updating your plan, you can ensure that your legacy is preserved and your loved ones are cared for according to your wishes.

Estate planning is a complex and nuanced process, and professional guidance can be invaluable. For those seeking expert assistance in estate planning in Montana, Montana Elder Law offers a wealth of experience and knowledge. Their dedicated team can provide the guidance and support needed to navigate the intricacies of estate planning, ensuring that your plan is tailored to your unique circumstances and goals. Whether you’re establishing a new estate plan or updating an existing one, Montana Elder Law can help you secure your legacy and provide peace of mind for you and your family.

Reference:

- Estate Planning 101: What is Estate Planning?, Patrick Hicks, https://trustandwill.com/learn/what-is-estate-planning