Understanding Elder Law: A Comprehensive Guide for Seniors and Their Families

January 17, 2024

Elder Law and Disability Rights in Montana: Understanding Your Protections

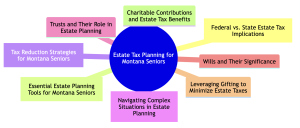

February 18, 2024Estate tax planning is a critical aspect of financial management for Montana seniors. It involves understanding and navigating the complex interplay of state and federal laws to ensure a secure financial legacy. This process is not just about reducing tax liabilities – it’s about making informed decisions that align with personal goals and family needs.

Key Takeaways:

- Montana offers a favorable estate tax environment with no state estate tax.

- Federal estate tax laws still apply, requiring strategic planning.

- Essential tools like wills, trusts, and powers of attorney are crucial.

- Trusts play a versatile role in estate planning, offering various types.

- Wills ensure asset distribution aligns with personal wishes.

Understanding Montana’s Estate Tax Landscape

Montana stands out as a state with no estate tax, making it an attractive place for seniors to manage their estate planning. However, understanding the broader tax landscape is crucial for effective planning.

Montana’s Estate Tax Environment:

| Aspect | Description | Federal Comparison |

| Estate Tax | Montana has no estate tax. | Federal estate tax applies to estates exceeding certain thresholds. |

| Exemptions | Not applicable in Montana. | Federal exemptions are adjusted annually for inflation. |

| Tax Rates | No state tax rates for estates. | Federal rates can be significant, up to 40% for qualifying estates. |

Federal vs. State Estate Tax Implications

Federal Estate Tax

The federal estate tax is a significant consideration for Montana residents with sizable estates. This tax applies to estates exceeding the exemption threshold, which the IRS adjusts annually for inflation.

As of my last update in April 2023, the exemption amount is substantial, but so are the tax rates for estates that exceed this limit. These rates can escalate quickly, reaching up to 40% for the largest estates. Therefore, it’s crucial for Montana residents, particularly those with high-value assets, to engage in strategic planning. This planning might involve tactics like lifetime gifting, setting up trusts, or leveraging life insurance policies to minimize the taxable estate and thus reduce the federal estate tax burden.

State Implications

Montana offers a distinct advantage in estate planning due to the absence of a state-level estate tax. This means that for Montana residents, the primary focus is on federal estate tax implications. However, this doesn’t diminish the importance of comprehensive estate planning. Residents must still consider how their estate will be affected by federal tax laws and plan accordingly. This planning includes understanding how different assets are taxed, the impact of federal tax laws on their estate, and the strategies available to mitigate these taxes.

Essential Estate Planning Tools for Montana Seniors

Estate planning in Montana encompasses a variety of tools, each serving a specific purpose in managing and protecting one’s legacy.

Key Tools:

-

Wills

A will is a fundamental estate planning tool that specifies how your assets should be distributed upon your death. It allows you to clearly state your beneficiaries and what they are to receive, whether it’s real estate, personal property, or financial assets. Wills can also be used to appoint guardians for minor children, ensuring that they are cared for according to your wishes. Without a will, your estate would be distributed according to state intestacy laws, which might not align with your personal preferences.

-

Trusts

Trusts offer a more flexible and often more protective way to manage your assets, both during your lifetime and after your death. They come in various forms, including revocable trusts, which can be altered or revoked during your lifetime, and irrevocable trusts, which are more permanent and often used for tax planning or asset protection. Trusts can help avoid probate, manage your estate’s privacy, and provide specific instructions for asset distribution, making them a valuable tool for more complex estates.

-

Powers of Attorney

Powers of attorney are crucial in estate planning, allowing you to appoint someone to make financial and healthcare decisions on your behalf if you become incapacitated. There are two main types: a healthcare power of attorney, which allows someone to make medical decisions for you, and a financial power of attorney, which gives someone the authority to handle your financial affairs. These documents ensure that your wishes are respected and that someone you trust is making decisions on your behalf.

Trusts and Their Role in Estate Planning

Trusts are a cornerstone of estate planning, offering flexibility and control.

- Revocable Trusts: Can be altered or revoked during the grantor’s lifetime.

- Irrevocable Trusts: Cannot be changed once established, offering stronger asset protection.

- Special Needs Trusts: Designed to benefit individuals with disabilities without affecting their eligibility for government benefits.

Wills and Their Significance

Asset Distribution

Wills are essential for specifying how your assets will be distributed, ensuring your wishes are honored.

Guardianship Nominations

They allow you to nominate guardians for minor children, providing peace of mind about their future care.

Complementing Trusts

Wills can work in tandem with trusts, covering assets not placed in trusts and ensuring a comprehensive estate plan.

Tax Reduction Strategies for Montana Seniors

Montana seniors have several strategies at their disposal to reduce estate taxes. These include gifting assets to loved ones, making charitable donations, and utilizing life insurance policies. Each strategy has its unique benefits and implications for estate tax planning.

Tax Reduction Strategies:

| Strategy | Description | Tax Implications |

| Gifting | Transferring assets to family or friends during your lifetime. | Reduces the taxable estate, subject to annual and lifetime exclusions. |

| Charitable Donations | Giving assets to charitable organizations. | Can provide significant tax deductions and reduce the taxable estate. |

| Life Insurance Policies | Using life insurance to provide for beneficiaries. | Proceeds are generally tax-free and can be structured to avoid inclusion in the estate. |

Leveraging Gifting to Minimize Estate Taxes

Gifting is a powerful tool in estate tax planning. By strategically gifting assets, seniors can significantly reduce their taxable estate. The IRS allows individuals to give a certain amount each year to an unlimited number of people without incurring gift tax. This annual exclusion is a critical component of tax planning.

Moreover, there’s also a lifetime gift tax exemption. This means that over your lifetime, you can gift a certain amount without incurring federal gift tax. These gifting strategies, when used effectively, can substantially lower the estate tax burden, ensuring more of your legacy goes to your loved ones. (1)

Charitable Contributions and Estate Tax Benefits

Charitable contributions are not only acts of generosity but also smart tax planning strategies.

Benefits of Charitable Contributions:

- Tax Deductions: Immediate tax deductions for the value of your gift.

- Reduced Estate Size: Lowering the value of your estate, potentially reducing estate taxes.

- Legacy Building: Contributing to causes you care about as part of your legacy.

- Avoidance of Capital Gains Tax: On gifts of appreciated assets like stocks.

Navigating Complex Situations in Estate Planning

Estate planning can be particularly challenging in complex family or financial situations. Blended families, business ownership, and non-traditional relationships all require careful consideration and planning.

Complex Estate Planning Scenarios:

| Scenario | Considerations |

| Blended Families | Ensuring fair distribution among biological and stepchildren. |

| Business Ownership | Business valuation, succession planning. |

| Non-Traditional Relationships | Legal protections for partners, children from previous relationships. |

Estate Planning for Business Owners

Business Valuation

Understanding the value of your business is crucial. Accurate valuation affects estate taxes and informs succession planning.

Succession Planning

Deciding who will take over your business is vital. A clear plan ensures smooth transition and preserves the business’s value.

Buy-Sell Agreements

These agreements dictate what happens to your business share upon your death, crucial for co-owned businesses.

Special Considerations for Blended Families

Blended families face unique estate planning challenges. It’s important to balance fairness and clarity in asset distribution.

Key Considerations:

- Inheritance for Stepchildren: Including stepchildren in your estate plan.

- Assets from Previous Marriages: Handling assets acquired before the current marriage.

- Guardianship Decisions: Especially for minor children from previous relationships.

Conclusion: Securing Your Legacy in Montana

Estate tax planning is essential for Montana seniors. It’s about making informed decisions that reflect your wishes and benefit your loved ones. Strategies like gifting, charitable donations, and careful planning for complex family situations can significantly impact how your legacy is preserved and passed on.

Montana Elder Law offers expert guidance in navigating these intricate processes. Check out their homepage for more information. Their expertise ensures your estate plan is not only compliant with current laws but also tailored to your unique family dynamics and financial situation. Trust Montana Elder Law to help secure your legacy and provide peace of mind for the future.

Reference:

(1) Estate and Gift Tax, IRS, https://www.irs.gov/businesses/small-businesses-self-employed/estate-and-gift-taxes