Social Security Benefits: The Big Picture

Social Security benefits help countless Americans. Anyone who has worked in the United States has contributed to the government program called Social Security. This program pools money from working people to provide for those who are eligible for SS and unable to work.

Social Security helps maintain financial stability for many, especially during non-working or needful years.

This guide from Montana Elder Law provides some big-picture information on social security and provides some essential tips for understanding what you are entitled to as a US citizen. We are proud to offer essential information related to elder law and financial planning.

Key Takeaways of Social Security Benefits

- Understanding Eligibility: Detailed criteria for qualifying based on age and work history.

- Maximizing Benefits: Strategies to optimize monthly payouts for greater financial security.

- Tax Implications: Insights into how benefits are taxed and what that means for your income.

- Timing Your Claim: The financial impact of the age at which you start claiming benefits.

- State-Specific Advice: Guidance specifically tailored to address the unique needs of Montana seniors.

What are Social Security Benefits?

Social Security benefits provide financial support to retirees, the disabled, and the families of retired, disabled, or deceased workers.

The system is funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA) or the Self Employment Contributions Act (SECA).

- Eligibility: You must be at least 62 years old for retirement benefits, but full benefits depend on your birth year, with full retirement age varying from 66 to 67. Work credits, generally earned by working and paying Social Security taxes, are required and depend on your age and the benefit type.

- Types of Benefits: Includes retirement, disability, survivors, and dependents benefits.

- Benefit Calculation: Calculated on your average indexed monthly earnings (AIME) during the 35 years in which you earned the most, adjusted for inflation.

Social Security Benefits Reference Table

| Criteria | Detail | Additional Information |

| Minimum Age | 62 (for reduced benefits) | Full benefits depend on birth year |

| Work Credits | 40 credits typically required (10 years) | Fewer credits may be needed for disability |

| Types of Benefits | Retirement, Disability, Survivors, Dependents | Each type has specific eligibility requirements |

| Calculation Base | Highest 35 years of indexed earnings | Benefits are adjusted annually for cost-of-living increases |

How to Apply for Social Security Benefits

Applying for Social Security benefits is straightforward if you know the process and what documents are needed.

Prepare to provide your Social Security number, birth certificate, proof of U.S. citizenship or lawful alien status, and details of your recent work.

- Gather Your Documents: Collect your Social Security card, birth certificate, proof of citizenship or legal residency, and employment records.

- Visit the SSA Website: The application forms are available on the official Social Security Administration (SSA) website.

- Complete the Application: Fill out the application form with accurate information about your work history and eligibility.

- Submit Your Application: You can submit the form online, mail it to your local SSA office, or schedule an appointment to apply in person.

- Wait for Approval: After submission, wait for the SSA to process your application and notify you of their decision.

When Should You Start Collecting Social Security Benefits?

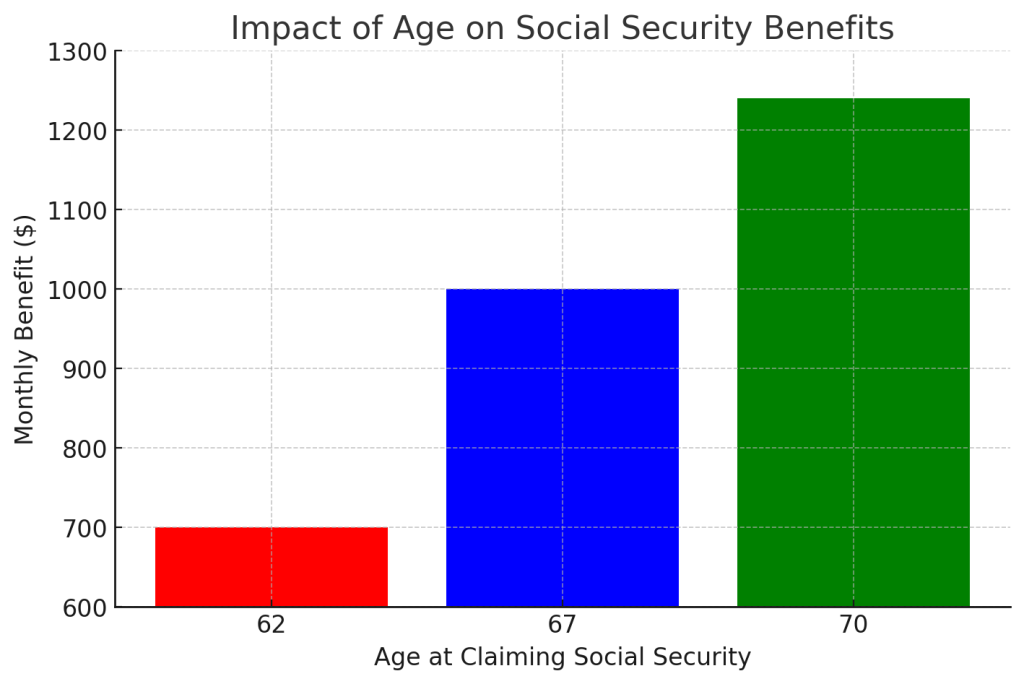

The decision on when to start collecting Social Security benefits can significantly affect your financial health in retirement.

Starting early at 62 will reduce your monthly benefits, whereas delaying up to age 70 increases them.

Benefit Adjustment Comparison

| Age | Monthly Benefit Adjustment |

| 62 | Reduced by about 30% |

| 67 | Full benefits |

| 70 | Increased by about 24% |

Visual: SS Benefit Differences By Claim Age

Statistics from CBPP.org – Based on $1000 per month @ 67 for reference (1)

Factors to Consider

Financial Needs

Evaluate both your current savings and anticipated future expenses.

If your savings are insufficient, consider claiming benefits earlier.

Conversely, if you can afford to wait, delaying benefits could increase your monthly payout.

Health Status

Your health is a crucial factor in deciding when to claim Social Security.

Claiming earlier could be a practical choice if you have health concerns that might limit your lifespan.

If you are in good health and have a family history of longevity, delaying benefits could maximize your lifetime income.

Employment Status

If you are still working, consider delaying Social Security.

Claiming benefits while working can temporarily reduce your benefits if you earn above a certain threshold.

Tips for Maximizing Your Social Security Benefits

Maximizing Social Security income requires thoughtful planning and strategic decisions.

Here are key strategies that can help Montana seniors enhance their retirement benefits:

- Work Longer: Extending your career can increase your average earnings, potentially boosting your monthly benefit.

- Spousal Benefits Coordination: Optimize your benefits by understanding and leveraging spousal benefit options.

- Manage Additional Income: Know how other income can affect your Social Security taxes and benefits.

Strategic Considerations

Delay Benefits

Delaying Social Security claims can significantly increase your monthly benefits.

Each year you delay increases your monthly payout up until age 70.

Work History

Your Social Security benefits are calculated based on your 35 highest-earning years.

Boosting your income during these peak years can raise your benefit amount.

Spousal Coordination

Effective coordination of benefits between spouses can maximize your household’s total Social Security income. Explore strategies like claiming one benefit early and delaying the other.

Conclusion: An Elder Law Firm Dedicated to Montana’s Seniors

This guide provides detailed practical strategies for optimizing Social Security benefits, which are essential for enhancing financial stability for seniors in Montana.

Seniors can significantly improve their retirement outcomes by extending work years, effectively coordinating spousal benefits, and understanding the connection of additional income with Social Security.

For personalized support and strategic planning, turn to Montana Elder Law. With their profound expertise in elder law and commitment to the financial well-being of Montana’s seniors, they stand ready to help you navigate the complexities of Social Security and optimize your retirement benefits—Trust Montana Elder Law to guide you toward a secure financial future.

References:

- Policy Basics: Top Ten Facts About Social Security – CBPP.org