How to Contest a Will: A Probate Attorney’s Prospective

July 15, 2024

How Does an Elderly Person Become a Ward of the State

July 15, 2024Introduction – Medicaid for Married Couples

Planning for Medicaid for married couples involves evaluating income and assets, gathering all necessary financial records, accurately completing the application, and consulting with an elder law attorney to ensure financial protection for the community spouse while securing long-term care benefits.

Eligibility for Medicaid in Montana for a married couple generally requires that the applicant’s monthly income be below $2,742, with countable assets under $3,000. Additionally, the community spouse is allowed to retain up to $148,620 in assets.

This guide from Montana Elder Law provides insights into strategies, spousal protections, income considerations, asset division, and the benefits of legal assistance.

If you or a loved one is in need of Medicaid planning, Montana Elder Law is a trusted resource.

Key Takeaways

- Evaluate Your Assets Early: Start by assessing your financial situation to understand what needs protection.

- Learn About Spousal Protections: Explore legal provisions that safeguard the community spouse’s financial stability.

- Understand Income Limits: Know the income thresholds to determine eligibility and plan accordingly.

- Consult with an Expert: Seek advice from an elder law attorney to craft a personalized Medicaid plan.

- Implement Legal Strategies: Use trusts, asset transfers, and spend-down methods to meet Medicaid requirements without depleting resources.

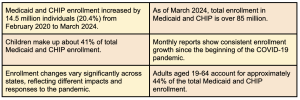

The Facts: General Medicaid Facts in 2024

Understanding Medicaid for Married Couples

Medicaid is a federal and state program that helps cover healthcare costs for people with limited income and resources.

For married couples, Medicaid planning becomes critical when one spouse requires long-term care.

The goal is to qualify for benefits while protecting the healthy spouse from financial hardship.

Eligibility criteria for Medicaid vary by state but generally include income and asset limits. Misconceptions abound, such as the need to deplete all assets before qualifying.

However, with proper planning, couples can often retain significant assets and still meet eligibility requirements. It’s crucial to understand the difference between countable assets (like cash, investments) and exempt assets (like the primary home, personal belongings).

Planning ahead with the guidance of a knowledgeable elder law attorney can help navigate these rules effectively, preserving the couple’s financial well-being.

Special Considerations: Medicaid for Married Couples

Medicaid planning for married couples comes with unique challenges. One spouse may need care while the other remains at home.

This situation requires careful planning to avoid financial strain on the healthy spouse.

- Income Limits: Medicaid has strict income limits which can affect eligibility.

- Asset Protection: Strategies to protect assets from being depleted by long-term care costs.

- Spousal Impoverishment Protections: Laws designed to prevent the healthy spouse from becoming impoverished.

Medicaid for Married Couples: Income and Asset Rules

Countable vs. Exempt Assets

Medicaid differentiates between countable and exempt assets.

Countable assets include cash, stocks, and bonds. Exempt assets typically include the primary home, personal belongings, and one vehicle.

Understanding these distinctions is critical for effective planning.

Spousal Income Protections

Medicaid rules offer protections to the community spouse, allowing them to retain a portion of the couple’s income.

This ensures the healthy spouse can maintain a reasonable standard of living while the other spouse receives care.

Community Spouse Resource Allowance (CSRA)

The CSRA allows the community spouse to keep a portion of the couple’s countable assets up to a specified limit.

This limit varies by state and helps protect the financial security of the spouse not in long-term care.

Division of Assets

During the Medicaid application process, the couple’s assets are assessed and divided.

The community spouse can retain a portion of these assets, while the rest must be spent down to meet Medicaid eligibility criteria.

Strategies for Medicaid Planning

Effective Medicaid planning involves strategies to legally protect assets while qualifying for benefits.

These strategies can include setting up trusts, transferring assets, and spending down in allowable ways. (1)

Comparison of Medicaid Planning Strategies

| Strategy | Benefits |

| Setting up Trusts | Protects assets and ensures funds are available for the community spouse. |

| Transferring Assets | Moves assets out of countable status to meet eligibility criteria. |

| Spending Down | Allows for the purchase of exempt assets to reduce countable assets. |

| Income-Only Trusts | Converts countable assets into a stream of income for the community spouse. |

| Legal Guidance | Ensures compliance with Medicaid rules and maximizes asset protection. |

The Medicaid Application Process

Applying for Medicaid involves several essential steps.

It starts with gathering necessary documents and ends with filing the application correctly. Each step requires careful attention to detail to avoid delays or denials.

- Gather Documents: Collect financial records, identification, and medical information.

- Complete Application: Fill out the Medicaid application form accurately.

- Submit Application: File the application with the local Medicaid office.

- Follow Up: Track the application status and respond to any requests for additional information.

- Interview: Attend an interview if required by Medicaid.

- Receive Decision: Await the approval or denial notice and understand the next steps.

Potential Pitfalls and How to Avoid Them

Common mistakes in Medicaid planning can lead to denial or delays.

One significant error is failing to properly document assets and income.

This can result in inaccuracies that hinder eligibility. Another pitfall is misunderstanding asset transfer rules.

Transfers made within the five-year look-back period can trigger penalties, delaying benefits.

Avoid these mistakes by consulting with an experienced elder law attorney.

They can help ensure accurate documentation and guide you through the asset transfer rules.

Proper legal guidance is helpful in navigating Medicaid’s complex requirements, ultimately saving time and money.

Role of an Elder Law Attorney

Hiring an elder law attorney provides substantial benefits when planning for Medicaid. They offer expertise in navigating Medicaid rules, protecting assets, and streamlining the application process.

An attorney ensures compliance with complex laws, reducing the risk of errors that could lead to asset loss or application denial. They also provide tailored strategies to meet eligibility requirements while safeguarding your financial future.

Comparison of Self-Planning vs. Professional Legal Assistance

Legal Knowledge

Self-planning often involves a limited understanding of complex Medicaid laws, increasing the likelihood of mistakes. In contrast, professional legal assistance offers in-depth knowledge and experience, ensuring all legal nuances are addressed correctly.

Asset Protection

Without professional help, there’s a higher risk of errors and asset loss. Elder law attorneys implement effective strategies to protect assets and meet Medicaid eligibility requirements.

Application Process

The self-planning route can lead to mistakes and delays. Attorneys handle the application efficiently and follow up as needed, reducing processing time and stress.

Outcome

Self-planned applications often result in uncertain and less favorable outcomes. Professional legal assistance increases the likelihood of successful approval and better results, providing peace of mind and financial security.

Planning Medicaid for Married Couples in Montana

Married couples planning for Medicaid should familiarize themselves with their state’s enrollment procedures, their spousal protection needs, and their own financial standing. Once these are in order, you can follow the enrollment process to begin receiving your benefits.

We understand this can be a bit complex – that is why Montana Elder Law is so happy to provide guidance on these matters. We welcome you to call with question or stop by for a visit.

Montana Elder Law has been providing sound legal guidance for over a decade. We take pride in our client focused approach and always give folks the respect and attention they deserve. Visit us online HERE.

Reference:

(1) American Council on Aging, What Counts as Income for Medicaid Long Term Care? Definitions, Exceptions & Limits, https://www.medicaidplanningassistance.org/how-medicaid-counts-income/