Survivorship Life Insurance Policies

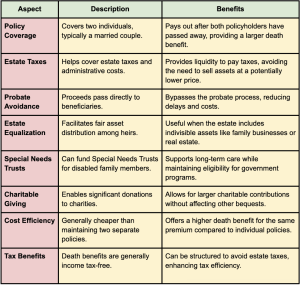

Survivorship life insurance policies are helpful in estate planning by providing a substantial death benefit that can cover estate taxes, facilitate asset distribution among heirs, and support long-term financial goals for beneficiaries.

Also known as second-to-die policies, survivorship life insurance covers two individuals and pays out after both policyholders have passed away.

Montana Elder Law knows a thing or two about Estate Planning. Our expert attorneys have helped countless people with their estate planning and we welcome you to call with questions!

Key Takeaways

- Provides a larger death benefit for the same premium: Survivorship policies generally offer higher death benefits compared to two individual policies.

- Helps cover estate taxes and administrative costs: The death benefit can be used to pay estate taxes and other related costs, reducing the financial burden on heirs.

- Avoids probate and delays: Life insurance proceeds pass directly to beneficiaries, bypassing the probate process.

- Useful for estate equalization among heirs: Helps distribute assets fairly among heirs, especially when the estate includes indivisible assets.

- Can be part of a Special Needs Trust: Supports financial planning for dependents with special needs by funding trusts designed for their long-term care.

Key Facts About Survivorship Life Insurance in Estate Planning

Benefits of Survivorship Life Insurance Policies

Survivorship life insurance policies offer several distinct advantages, particularly for estate planning.

They can provide significant financial relief by offering a larger death benefit for the same premium, making them an efficient choice for covering estate taxes and other expenses. This benefit means that assets don’t need to be liquidated quickly, which can often result in a lower sale price.

Additionally, avoiding probate helps expedite the transfer of wealth to beneficiaries without the delays and costs associated with the probate process.

Maintaining such policies also comes with cost savings, as they are typically less expensive than two individual policies for each spouse. This affordability makes them an attractive option for couples looking to maximize their estate planning benefits.

Integrating survivorship life insurance into an estate plan achieves tax efficiency, liquidity, and cost savings while beneficiaries receive the intended inheritance without unnecessary complications or financial burdens.

Benefits of Survivorship Life Insurance

| Benefit | Description |

| Larger Death Benefit | Offers a higher death benefit for the same premium compared to individual policies. |

| Tax Efficiency | Death benefits are generally income tax-free and can be structured to avoid estate taxes. |

| Liquidity | Provides cash to pay estate taxes and other expenses, avoiding the need to liquidate assets. |

| Avoids Probate | Proceeds pass directly to beneficiaries, bypassing the probate process. |

| Cost Savings | Generally cheaper than maintaining two separate policies for each spouse. |

Common Uses of Survivorship Life Insurance in Estate Planning

Survivorship life insurance policies serve multiple purposes in estate planning.

They help balance inheritances among heirs, facilitate significant charitable donations, and provide for loved ones with special needs. (1)

Estate Equalization

Survivorship policies are excellent tools for estate equalization.

When an estate includes assets like family businesses or real estate that are difficult to divide, these policies can provide liquidity.

For instance, one heir might receive the family business, while others get equivalent value through the policy’s death benefit. This approach helps avoid potential disputes and ensures fair distribution among heirs.

Charitable Giving

Survivorship life insurance policies can be used to make significant charitable contributions without impacting other bequests.

By naming a charity as a beneficiary, policyholders can be sure a substantial donation is made, free from the delays and costs of probate. This method allows for a larger charitable gift than might be possible through direct cash donations.

Special Needs Trusts

Funding Special Needs Trusts with survivorship policies is another strategic use.

Parents or caregivers can provide for the long-term care of a disabled family member by using the policy’s death benefit to fund the trust.

This arrangement helps maintain the beneficiary’s eligibility for government programs while meeting their financial needs.

How to Incorporate Survivorship Life Insurance Policies into Your Estate Plan

Integrating survivorship life insurance into your estate plan involves several steps.

Each step helps tailor the policy to fit your specific needs and goals.

- Assess your estate planning goals: Determine what you want to achieve with your estate plan, such as providing for heirs, minimizing taxes, or supporting a charity.

- Consult with a financial advisor: Seek professional advice to understand how survivorship life insurance fits into your overall plan.

- Determine the appropriate coverage amount: Decide on the coverage amount that aligns with your estate’s needs and goals.

- Choose the right policy type: Select a policy that best suits your situation, whether it’s whole life, universal life, or another type.

- Regularly review and update the policy as needed: Keep your policy current with regular reviews to reflect changes in your estate, tax laws, and personal circumstances.

Potential Drawbacks and Considerations

Survivorship life insurance policies offer many benefits, but there are also important considerations to keep in mind.

It’s essential to understand potential drawbacks before making a purchase.

Possible Downsides to Survivorship Life Insurance Policies

One significant issue arises if one spouse needs a benefit payout for living expenses. ‘

Since survivorship policies pay out only after both policyholders have passed away, they won’t provide immediate financial support for a surviving spouse.

Maintaining premiums is another critical factor.

Consistent premium payments are required to keep the policy active, which might be challenging over the long term.

The complexity of these policies often necessitates professional advice. Navigating the details and ensuring the policy fits well into an overall estate plan can be complicated.

Lastly, changes in estate tax laws can impact the policy’s utility. Legislative adjustments may alter the benefits or tax advantages that currently make survivorship life insurance attractive.

Key Considerations for Survivorship Life Insurance Policies

- Not suitable if one spouse needs a benefit payout for living expenses.

- Premiums must be maintained to keep the policy in force.

- Policy complexity may require professional advice.

- Possible estate tax law changes affecting policy utility.

Survivorship Life Insurance Policies and Estate Planning | Montana Elder Law

Survivorship life insurance policies help with estate planning by providing a larger death benefit, helping cover estate taxes, and facilitating fair asset distribution among heirs. These policies also support charitable giving and fund Special Needs Trusts.

This is an estate planning approach that is gaining attention and is definitely worth consideration if your circumstances call for it.

Montana Elder Law offers expertise in crafting tailored estate plans that incorporate survivorship life insurance policies. Our many years of experience have made us a great resource for anyone in Montana interested in estate planning. Reach out to Montana Elder Law to discuss how survivorship life insurance can benefit your estate plan.

Reference:

(1) Progressive, What is survivorship life insurance?, https://www.progressive.com/answers/survivorship-life-insurance/