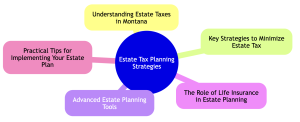

Introduction: Attorneys’ Advise for Montana Estate Tax Planning

Estate tax planning is important for Montana residents who want to preserve their wealth for future generations.

While Montana does not levy a state estate tax, federal estate taxes can still pose significant financial implications. This guide outlines effective strategies to minimize these taxes and ensure your legacy thrives.

Montana Elder Law is committed to serving our communities with sound Estate Planning expertise. Please use this blog as a resource to help solidify your asset protection.

Key Takeaways – Montana Estate Tax Planning

- Utilize Gifting: Leverage the annual and lifetime gift exclusions to reduce your taxable estate.

- Establish Trusts: Protect and manage assets across generations while minimizing tax exposure.

- Charitable Donations: Reduce your taxable estate and support charitable causes simultaneously.

- Maximize Exemptions: Stay informed about federal exemptions and plan accordingly.

- Timely Planning: Engage in estate planning early to adapt to tax law changes and personal circumstances.

Estate Tax Planning in Montana

Montana offers a tax-friendly environment for estate planning as it does not impose its own estate tax.

However, Montana residents must still consider mandatory federal estate taxes, which can claim a significant portion of an estate exceeding certain thresholds.

- Federal Estate Tax Exemption: For 2023, the federal estate tax exemption is $12.92 million per individual, meaning estates valued below this amount are not subject to federal estate taxes.

- Rate of Taxation: The federal estate tax rates can be as high as 40% for amounts above the exemption threshold, significantly impacting the value of an estate passed on to heirs.

- Annual Gift Exclusion: In 2023, the annual gift exclusion allows an individual to give up to $17,000 to an unlimited number of people without incurring federal gift tax, further reducing the size of the taxable estate. (1)

Key Strategies to Minimize Estate Tax

Maximizing Federal Exemptions

The federal lifetime exemption allows individuals to pass a significant amount of assets without incurring estate taxes. For 2023, this exemption stands at $12.92 million per person.

It’s crucial to plan around this exemption, especially since it’s scheduled to decrease to about $6.6 million in 2026. Proactive planning can help you fully utilize the exemption before the reduction.

Annual Gifting

Annual gifting is a strategic way to reduce your taxable estate without diminishing your lifetime exemption.

In 2023, you can gift up to $17,000 per recipient per year without this counting against your lifetime exemption. This method is particularly effective for gradually transferring wealth and reducing the size of your estate over time.

Charitable Contributions

Charitable giving not only supports worthy causes but also provides substantial tax benefits:

- Tax Deductions: Contributions to qualified charities are tax-deductible, reducing your taxable income.

- Estate Reduction: Charitable contributions made through your will can reduce the size of your estate, potentially lowering estate taxes.

- Legacy Building: Using charitable trusts can help continue your philanthropic impact beyond your lifetime.

Advanced Estate Planning Tools

Estate planning involves various tools to help minimize taxes and guarantee that your assets are distributed according to your wishes. Here’s a deeper look at some sophisticated strategies:

- GRATs (Grantor Retained Annuity Trusts): Allows the grantor to transfer asset appreciation to beneficiaries tax-free after receiving annuity payments for a set period.

- QPRTs (Qualified Personal Residence Trusts): Enables the transfer of a personal residence to heirs at a reduced tax cost while the grantor continues to live in the home for a term specified in the trust.

- ILITs (Irrevocable Life Insurance Trusts): Excludes life insurance proceeds from the taxable estate, providing tax-free benefits to beneficiaries.

Table: Comparing Estate Planning Tools

| Tool | Benefit | Ideal Scenario |

| GRAT | Transfers asset growth out of estate | High-appreciation assets |

| QPRT | Reduces gift tax on home transfer | Personal residences |

| ILIT | Provides tax-free benefits | Large life insurance policies |

Using Trusts Effectively

Trusts are a highly effective tool for advanced estate planning.

They offer a way to manage how assets are distributed to beneficiaries and can significantly minimize estate taxes. Let’s explore how to utilize different types of trusts:

- Revocable Trusts: Often used for their flexibility, allowing the grantor to retain control over assets during their lifetime with the ability to alter the trust terms.

- Irrevocable Trusts: Once established, these trusts cannot be changed, which removes the assets from the grantor’s taxable estate, reducing estate tax liability.

- Charitable Remainder Trusts (CRTs): These allow you to receive income for a period of time, with the remainder of the trust assets going to a charity, reducing both income and estate taxes.

Effectively using these estate planning trusts involves choosing the right type of trust and correctly aligning it with your overall estate planning goals.

Consulting with an estate planning attorney can provide personalized advice and ensure your estate plan is robust and tax-efficient.

The Role of Life Insurance in Estate Tax Planning

Life insurance plays a strategic role in estate planning.

By providing liquidity at death, life insurance can help cover estate taxes and other expenses without immediately liquidating other estate assets. This is particularly beneficial in managing cash flow and maintaining the estate’s value.

Another significant benefit comes from establishing an Irrevocable Life Insurance Trust (ILIT).

An ILIT allows the life insurance policy to be removed from the estate, meaning it is not subject to estate taxes. This setup ensures that the full life insurance payout goes directly to the beneficiaries rather than paying estate taxes, thus preserving more of your assets for your heirs.

Practical Tips for Implementing Your Estate Plan

Effective estate planning is about strategic management and foresight.

Here’s how to guarantee that your estate plan achieves your goals:

- Choose the Right Advisors: Engage with professionals specializing in estate law and tax planning. Their expertise will be crucial in navigating the complexities of estate and tax laws.

- Regularly Review Your Plan: Life changes—so should your estate plan. Regular reviews will help address changes such as new laws, financial situation changes, or family structure shifts.

- Coordinate with Financial and Legal Professionals: Make sure your financial advisor, elder law attorney, and accountant are coordinated. Their combined knowledge can ensure all aspects of your estate plan work together effectively.

Estate Tax Planning With Montana Elder Law

Estate tax planning is essential, especially for residents of Montana who need to consider federal implications despite the absence of state estate tax. Proactive planning helps maximize the wealth passed on to your heirs and can significantly reduce the federal tax burden on your estate.

Montana Elder Law is a trusted partner in Montana Estate Planning. With their expertise, you can tailor an estate plan that suits your unique needs, preserving and protecting your legacy.

Trust Montana Elder Law to guide you through the complexities of estate planning with precision and care.

References:

(1) SmartAsset, Montana Estate Tax, https://smartasset.com/estate-planning/montana-estate-tax