Asset Protection Strategies for Medicaid

May 1, 2024

Setting Up Trusts for Asset Protection

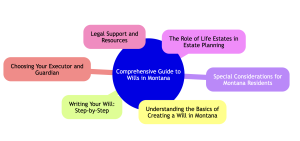

May 31, 2024Understanding the Basics of Drafting a Will in Montana

Drafting a will in Montana doesn’t have to be daunting.

It’s a straightforward process that ensures your wishes are honored after you pass.

This guide from Montana Elder Law explains the legal jargon and walks you through each necessary step in drafting a will.

Remember, a well-crafted will speaks for you when you no longer can.

Key Takeaways: Drafting a Will in Montana

- Legal Requirements for a Valid Will in Montana: Must be 18 or older and of sound mind, with the will written, signed by the testator, and witnessed by at least two independent witnesses.

- Choosing the Right Executor and Guardian: Select trustworthy and capable individuals to manage your estate and care for your minor children.

- Essential Elements of a Montana Will: Clearly identify the testator, declare the document as a will, and include clear beneficiary designations and asset distribution instructions.

- Impact of Property Types on Your Will: Understand that certain assets, like jointly held property or designated insurance beneficiaries, pass outside the will.

- Legal Support for Estate Planning: Utilize resources like the Montana State Bar or local legal aid services to find qualified estate planning attorneys.

Essential Elements of a Valid Will

In Montana, a will must meet specific criteria to be considered legally binding.

Firstly, the person creating the will (testator) must be at least 18 years old and of sound mind. The will should be in writing and signed by the testator in the presence of at least two witnesses, who also must sign the document, affirming they witnessed the testator’s signature. These witnesses should be disinterested parties, meaning they stand to gain nothing from the will.

Legal Criteria for a Valid Will in Montana

| Requirement | Description |

| Age | The testator must be at least 18 years old. |

| Capacity | The testator must be of sound mental capacity. |

| Written Document | The will must be written and signed. |

| Witnesses | Must be signed by at least two disinterested witnesses. |

Choosing Your Executor and Guardian (When Drafting a Will)

Selecting an executor and a guardian for your children is essential in preparing your will.

These roles come with significant responsibilities that impact how your assets and dependents are managed after your death.

Executor

The executor of your will is responsible for carrying out your final wishes as stipulated in the document. This role includes several vital duties:

- Probating the Will: Initiating the probate process to validate the will.

- Asset Management: Gathering and managing the estate’s assets until they are distributed. This includes safeguarding property, managing funds in estate accounts, and overseeing real estate maintenance.

- Debt Settlement: Paying off any debts and taxes owed by the estate. The executor must ensure that all financial obligations are met before distributing the assets to the beneficiaries.

- Asset Distribution: Distributing the remaining assets according to the will’s directives. This often involves liquidating properties, distributing funds, and transferring ownership of properties.

- Legal and Financial Filings: Completing necessary legal and financial filings throughout the probate process, including filing the final tax returns for the deceased.

Guardian

If you have minor children, choosing a guardian is essential to your will.

A guardian will be responsible for raising your children if you and the other parent cannot. Responsibilities include:

- Daily Care and Wellbeing: Providing for the children’s daily needs, including food, housing, education, and healthcare.

- Financial Management: Overseeing the children’s inheritances or trusts until they reach adulthood or the age specified in your will for inheritance.

- Emotional Support: Offering emotional support and stability, helping the children adjust to life without their parents.

- Decision Making: Making important decisions about the children’s education, health care, and general welfare.

It’s important to discuss the possibility of taking on this role with the chosen guardian in advance to ensure they are willing and prepared to take on such a significant responsibility.

Also, consider appointing an alternate guardian if your first choice cannot serve when needed.

Both roles require individuals who are trustworthy, organized, and capable of handling financial and legal matters. It’s wise to choose people who are capable, aligned with your values, and trusted by your family to handle these essential duties. (1)

Drafting a Will: Step-by-Step

Writing a will is a critical step in managing your affairs.

Start by clearly stating in the document that it is your will.

During this step, include your full name and residence to avoid any confusion.

Clearly identify the beneficiaries for specific assets to ensure your wishes are followed accurately.

Be precise about who gets what.

After you’ve detailed your wishes, it’s crucial to sign your will in the presence of witnesses to make it legally binding.

Witness Requirements for Drafting a Will in Montana

Montana law requires that at least two individuals witness your will. These witnesses must be present when you sign your will or acknowledge your signature.

Here’s how to ensure your will’s witnessing is foolproof:

- Choose the Right Witnesses: Select two adults who are not beneficiaries in your will to avoid potential conflicts of interest.

- Simultaneous Presence: Ensure both witnesses are present to observe you signing the will.

- Witness Signature: Each witness must sign the will while in your presence and the presence of each other.

- Clear Understanding: The witnesses should understand that the document they are signing is intended to be your will.

Special Considerations for Montana Residents

Montana’s unique laws might affect how you draft your will.

For example, Montana recognizes holographic (handwritten) wills as valid even if they aren’t witnessed, as long as the material provisions and signature are in the testator’s handwriting.

Additionally, electronic wills add a modern twist; these must meet specific standards to be valid.

Marriage and divorce significantly impact your will, too.

A new marriage might nullify existing will provisions, while a divorce typically revokes any benefits to a former spouse.

What Cannot Be Included in a Will

Certain types of property and designations cannot be directed through your will in Montana:

- Joint Tenancy Property: Property held in joint tenancy automatically passes to the surviving owner(s), not through the will.

- Life Insurance and Retirement Accounts: Your will does not cover these if beneficiaries are designated directly in the policy or account.

- Living Trusts: Property in a living trust passes according to the terms of the trust, not your will.

The Role of Life Estates in Estate Planning

Life estates are significant in estate planning.

Essentially, a life estate allows an individual, known as the life tenant, to use and benefit from a property for the duration of their life.

Upon their death, the property passes directly to another person, called the remainderman, without the need for probate.

This arrangement can be beneficial for ensuring that a cherished home remains in the family or is passed on to a specific heir with fewer complications.

Pros and Cons of Life Estates

- Pros:

- Avoids probate for the property.

- It can reduce estate taxes since the property is not considered part of the estate at death.

- Provides peace of mind to the life tenant, who can continue to live in the home.

- Cons:

- The life tenant is responsible for property taxes and upkeep, which can be burdensome.

- Reduces flexibility, as the life tenant cannot sell or mortgage the property without the remainderman’s consent.

- This can lead to conflicts if the life tenant and remainderman have different interests or plans for the property.

Legal Support and Resources When Drafting A Will

Legal support is always helpful when drafting a will.

Start by seeking an attorney who specializes in estate planning.

A specialized elder law attorney can make sure your will complies with Montana laws and truly reflects your wishes.

Resources such as the Montana State Bar offer referral services to help you find qualified legal professionals. Additionally, local legal aid organizations can provide guidance and sometimes free services if you qualify.

Montana Elder Law offices are particularly adept at navigating these waters. They not only draft wills but also offer comprehensive estate planning services, including advice on trusts, elder law, and probate administration.

Remember, choosing an experienced attorney can safeguard your interests and help streamline the complex estate planning process.

Conclusion: Drafting a Will With Montana Elder Law

Having a well-drafted will is an essential component of financial wellness.

It guarantees that your assets are distributed according to your wishes, provides for your loved ones, and can prevent unnecessary stress and family disputes.

The peace of mind that comes from knowing you have a solid plan in place is invaluable.

Montana Elder Law is a trusted name in legal services in the Big Sky state. It is appreciated for its expertise in estate planning and elder law. Montana Elder Law provides tailored advice to ensure that each client’s estate is handled with care and precision. For anyone looking to secure their legacy, Montana Elder Law is always ready to assist with professionalism and deep local expertise.

Reference:

(1) CDC Foundation, What is a Will?, https://www.cdcfoundation.org/give/will