Retirement Savings Strategies for Seniors: Big Picture

To maximize your retirement savings as a senior, focus on maximizing contributions to your 401(k) and IRA, utilize catch-up contributions, diversify your investments, and plan strategically for taxes and healthcare expenses.

Time is the key factor for these low-risk, long-term investments. If you start early, you’re almost guaranteed a great return with very attractive tax benefits. If you didn’t start early, catch-up contributions are your best friend.

The importance of retirement planning is growing as society increases life expectancy. Many individuals live well into their 90s—over twenty years since last working. We need to plan for more years of retirement than our parents.

This article from Montana Elder Law lays out the groundwork for retirement savings for seniors.

Key Takeaways

- Start saving early, but it’s never too late to begin.

- Maximize contributions to retirement accounts.

- Diversify investments for stability and growth.

- Plan for healthcare costs and other unexpected expenses.

- Consider the impact of taxes on retirement savings

Best Options for Diversifying Retirement Investments

Maximizing Contributions to Retirement Accounts

Contributing to retirement accounts such as 401(k)s, IRAs, and other retirement savings plans offers significant benefits.

Catch-up contributions can make a substantial difference for those aged 50 and older.

Increasing contributions as you age allows your savings to grow more rapidly due to compounding interest.

Catch-up Contributions

Catch-up contributions are additional contributions that individuals aged 50 and older can make to their retirement accounts, such as 401(k)s and IRAs.

These contributions allow seniors to save more money than the standard annual limits.

For example, in 2024, the catch-up contribution limit for 401(k)s is an extra $7,500, and for IRAs, it is an additional $1,000.

These extra contributions help seniors boost their retirement savings as they approach retirement age.

401 (k)

Employer-sponsored 401(k) plans often offer matching contributions, which are essentially free money added to savings.

For instance, if your employer matches 50% of your contributions up to 5% of your salary, you’re gaining additional funds without extra effort.

Always contribute enough to take full advantage of this match.

IRA

IRAs are another excellent tool.

Traditional IRAs allow pre-tax contributions, which can reduce your taxable income now, while Roth IRAs offer tax-free withdrawals in retirement.

Both types have annual contribution limits, but those over 50 can make additional catch-up contributions.

This boost can significantly enhance your retirement fund.

Diversify

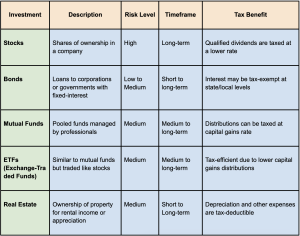

Diversifying your investment portfolio within these accounts is also beneficial. Combining stocks, bonds, and other investment vehicles can stabilize your returns and protect against market volatility. The goal is to create a balanced portfolio that grows steadily while minimizing risks as you approach retirement age.

Retirement Savings: Diversifying Your Investment Portfolio

Stocks and Bonds

Balancing stocks and bonds in your portfolio is key to reducing risk while maintaining growth potential.

Stocks offer high growth potential but come with higher risk. Conversely, bonds are generally safer but provide lower returns.

For seniors, a balanced mix of stocks and bonds can stabilize returns, providing growth while protecting against market volatility.

The classic rule of thumb is to hold your age in bonds; for instance, a 60-year-old might have 60% in bonds and 40% in stocks.

Mutual Funds and ETFs

Mutual funds and ETFs (Exchange-Traded Funds) spread risk by pooling resources from many investors to invest in a diversified portfolio of stocks, bonds, or other securities.

They offer professional management, which can be beneficial if you’re not keen on picking individual stocks.

ETFs tend to have lower expense ratios than mutual funds and trade like stocks on exchanges, providing flexibility and often lower costs. (1)

Real Estate and Other Investments

Real estate can be a powerful addition to a retirement portfolio.

It provides potential income through rental properties and can appreciate over time.

Additionally, investing in REITs (Real Estate Investment Trusts) allows you to invest in real estate without the hassle of managing properties.

Other alternative investments like commodities or private equity can also diversify your portfolio, which offers protection against stock market fluctuations.

Retirement Savings: Planning for Healthcare and Long-term Care Costs

Healthcare costs are rising. It is essential to incorporate these expenses into your retirement plan.

Estimating future healthcare costs can prevent financial strain.

Consider long-term care insurance to cover services not included in regular health insurance.

Health Savings Accounts (HSAs) allow pre-tax contributions to grow tax-free for medical expenses.

Planning for out-of-pocket expenses ensures you’re prepared for unexpected costs.

Reviewing Medicare and Medicaid options can help you understand coverage and potential gaps.

- Estimate future healthcare costs.

- Consider long-term care insurance.

- Utilize Health Savings Accounts (HSAs).

- Plan for out-of-pocket expenses.

- Review Medicare and Medicaid options.

Understanding Social Security Benefits

Claiming Social Security benefits is a critical step in retirement planning.

Eligibility typically starts at age 62, but delaying claims can significantly increase your monthly benefits. For instance, waiting until age 70 can boost your benefits by up to 32%.

Understanding the impact of your work during retirement is also essential. Earning income while receiving Social Security can affect the benefits you receive.

Strategizing your Social Security claims to maximize your overall retirement income is wise.

- Eligibility criteria and age considerations.

- Strategies for maximizing benefits.

- Impact of working during retirement on Social Security.

Retirement Savings: Tax-efficient Withdrawal Strategies

Tax planning in retirement is essential to maximize your savings.

Different types of retirement accounts have varying tax implications, and understanding these can save you a significant amount of money.

For example, withdrawals from traditional 401(k)s are taxed as ordinary income. In contrast, Roth IRAs offer tax-free withdrawals, provided certain conditions are met.

Strategically planning your withdrawals can minimize your tax burden.

Start by withdrawing from taxable accounts to keep your taxable income lower and delay withdrawals from tax-deferred accounts like 401(k)s. This method can reduce the amount of income subject to higher tax rates.

Additionally, consider Roth conversions during low-income years to benefit from lower tax rates on converted amounts.

Thoughtful planning in this area can enhance the longevity of your retirement funds.

Estate Planning and Leaving a Legacy

Estate planning is significant to make sure your assets are distributed according to your wishes.

It’s not just for the wealthy; anyone with assets should consider an estate plan.

Estate plans guarantee your loved ones are taken care of and can prevent legal complications.

Making an Estate Plan

- Creating a will: A will outlines how your assets will be distributed and can designate guardians for minor children.

- Setting up trusts: Trusts can help manage and distribute your assets efficiently, often reducing estate taxes and avoiding probate.

- Assigning power of attorney: This allows someone to make legal and financial decisions on your behalf if you become incapacitated.

- Beneficiary designations: Ensure your retirement accounts and insurance policies have up-to-date beneficiaries.

- Planning for estate taxes: Understand your potential estate tax liability and explore strategies to minimize it.

Retirement Saving Tips for Seniors | Montana Elder Law

Proactive planning and diversified investments are critical components of a successful retirement strategy. By focusing on maximizing contributions, understanding tax-efficient withdrawal strategies, and planning for healthcare costs, seniors can achieve financial stability and peace of mind in retirement.

Montana Elder Law is a trusted resource for seniors seeking personalized guidance in retirement planning and legal support. Our expertise makes retirement planning simple, so your future is secure and well-planned.

Visit our HOMEPAGE for more information and resources!

Reference:

(1) Investopedia, 8 Essential Tips for Retirement Saving , https://www.investopedia.com/articles/investing/111714/8-essential-tips-retirement-saving.asp